How are the interest rate and monthly payments calculated?

We use the same method used by other financial institutions to calculate the fixed periodic payments.

The periodic payments are determined so that, for a given interest rate, the future periodic payments are equivalent to receiving back the investment today. Goparity uses the 30/360 day-count method, which considers a 30-days month and a 360-days year.

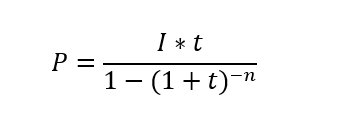

To determine your periodic payment, we use the following formula:

Where:

P = periodic payment

I = amount invested stipulated on the mutual agreement at the time of issuance

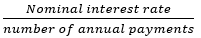

r = periodic interest rate, i.e.,

Nominal interest rate = project’s interest rate

n = total number of payments that include interest and reimbursement of the amount owed

Please note this formula only works if the periodic payment includes interest and part of the reimbursement of the amount owed.

Most Frequently Asked:

Goparity Canada is a sustainable finance platform and app that aims to democratize access to impact investing. By prioritizing accessibility, we make it possible for all kinds of investors to contribute to sustainable development projects in Canada. Goparity is one of the fastest growing platforms in Europe, and Goparity Canada is co-owned and operated by Canadian entrepreneurs. Goparity Canada humbly acknowledges the Indigenous Peoples who have stewarded the lands and waters of the places we call home. To realize a just and sustainable future we recognize the harmful legacy of colonization, both past and present, and go forward together in the spirit of reconciliation. Peel Region is part of the Treaty Lands and Territory of the Mississaugas of the Credit. In particular, we acknowledge the territory of the Anishinabek, Huron-Wendat, Haudenosaunee and Ojibway/Chippewa peoples; the land that is home to the Metis; and most recently, the territory of the Mississaugas of the Credit First Nation.

60 Admiral Blvd.

Mississauga, ON

Canada

© 2024 Goparity Canada

Goparity Canada Securities Inc. is a licenced Exempt Market Dealer (EMD) in British Columbia, Alberta, Manitoba, Ontario, and Nova Scotia. Part or all of your original invested capital may be at risk and the return on your investment depends on the success of the corresponding small to medium-sized business invested in. Any historical returns, expected returns, or projections may not reflect actual future performance.

Go back

Go back